BOI Reporting Platform For Accountants

Unlock New Revenue Streams & Mitigate Risks

Our BOI filing platform revolutionizes your CTA compliance workflow, enhancing efficiency, accuracy, and client protection. Leverage this tool to create a new revenue stream while delivering indispensable services to your clientele.

BOI Report Filing Software

Schedule a Complimentary Demo

Software Made By the Same Company That Manages Filings For

Is Your Accounting Practice Overlooking the Profitable Potential of BOI Reporting Services?

Discover How Neglecting CTA Compliance Could Be Impacting Your Bottom Line and Client Relationships

Untapped Revenue Potential

Are you maximizing your earning potential by offering comprehensive CTA compliance services to your client base?

Time-Intensive Manual Processes

Traditional filing methods can consume up to 2.5 hours per report, diverting valuable staff resources from billable tasks.

Compliance Pitfalls and Financial Consequences

Intricate requirements and convoluted forms increase the risk of costly mistakes, potentially resulting in penalties for both your firm and clients.

Rising Threat of Fraudulent Activities

Unscrupulous actors are capitalizing on CTA-related confusion, targeting your clients through various communication channels and jeopardizing their sensitive data.

Resource Drain

Evaluate the true cost of inefficient CTA compliance procedures on your firm’s time and financial resources.

Safeguarding Your Professional Reputation

Prevent filing inaccuracies from tarnishing your firm’s standing and undermining client confidence.

The All-Encompassing CTA Compliance Platform for Accounting Firms

Optimize Time Management, Eliminate Errors, Safeguard Clients, and Boost Revenue with Our Innovative Solution

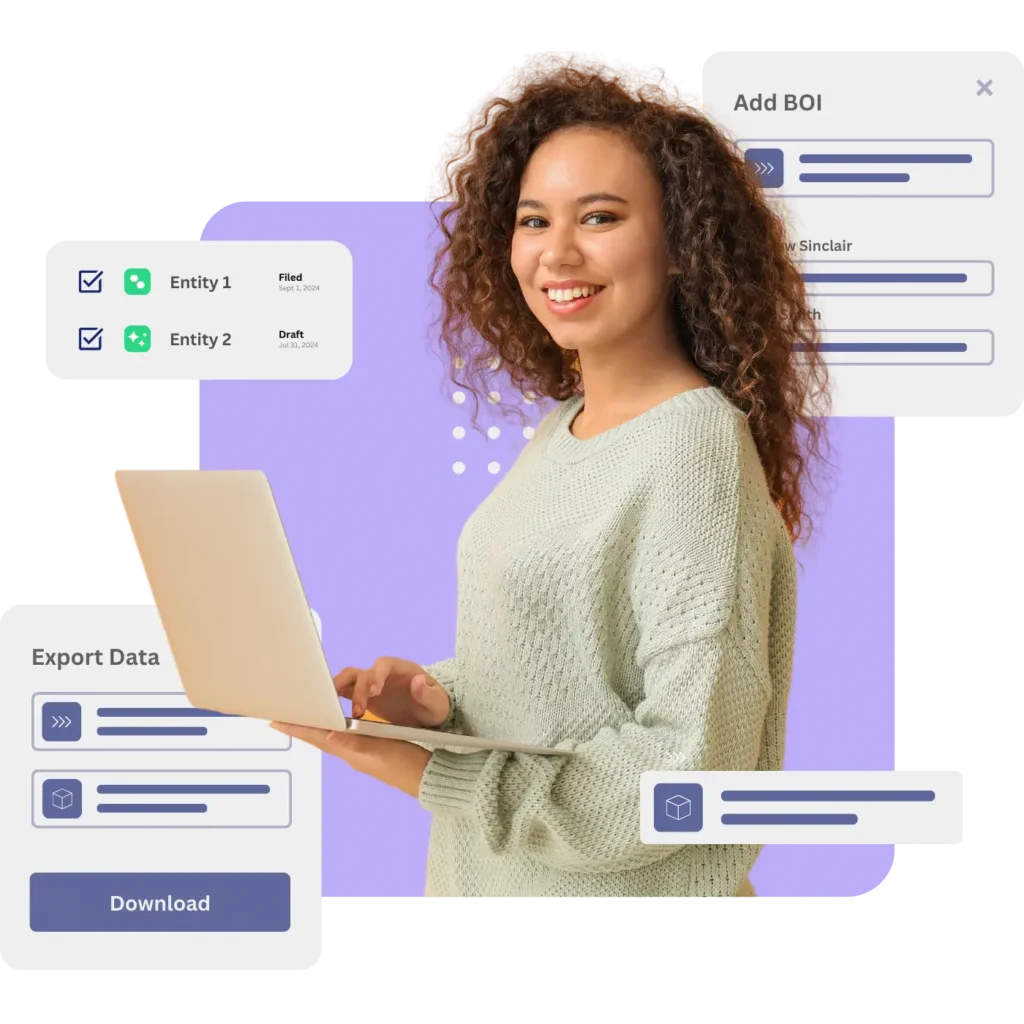

Revolutionize Your FinCEN Filing Process

Complete reports in just 5 minutes with our streamlined system. Deliver ongoing CTA compliance without expanding your workforce, thanks to our intuitive automated tools.

Eradicate Errors and Avoid FinCEN Penalties

Benefit from automated data validation and expert guidance to ensure filing accuracy and compliance. Our multi-layered verification process, including automated checks, client approval, and final reviews, guarantees the integrity of every submission.

Shield Your Clients from Fraudulent Communications

Protect your clients’ sensitive information with our secure, encrypted storage and controlled access protocols. Provide a seamless, secure reporting pathway through a simple invitation link.

Elevate BOI Reporting to Your Most Profitable Offering

Transform CTA compliance into a high-margin service that enhances client loyalty, satisfaction, and your firm’s revenue streams.

How it Works

Schedule a FREE

Complimentary Demo

Select a convenient time to discuss your beneficial ownership reporting needs with our team.